دسته بندی ها

محصولات پرفروش

-

لپ تاپ دل

تومان25.000.000

لپ تاپ دل

تومان25.000.000

-

اسپیکر مینی

تومان699.000

اسپیکر مینی

تومان699.000

-

اسپیکر رنگی

تومان2.000.000

اسپیکر رنگی

تومان2.000.000

-

اسپیکر شیانومی

تومان2.100.000

اسپیکر شیانومی

تومان2.100.000

-

اسپیکر جیبی

تومان450.000

اسپیکر جیبی

تومان450.000

تگ محصولات

گالری

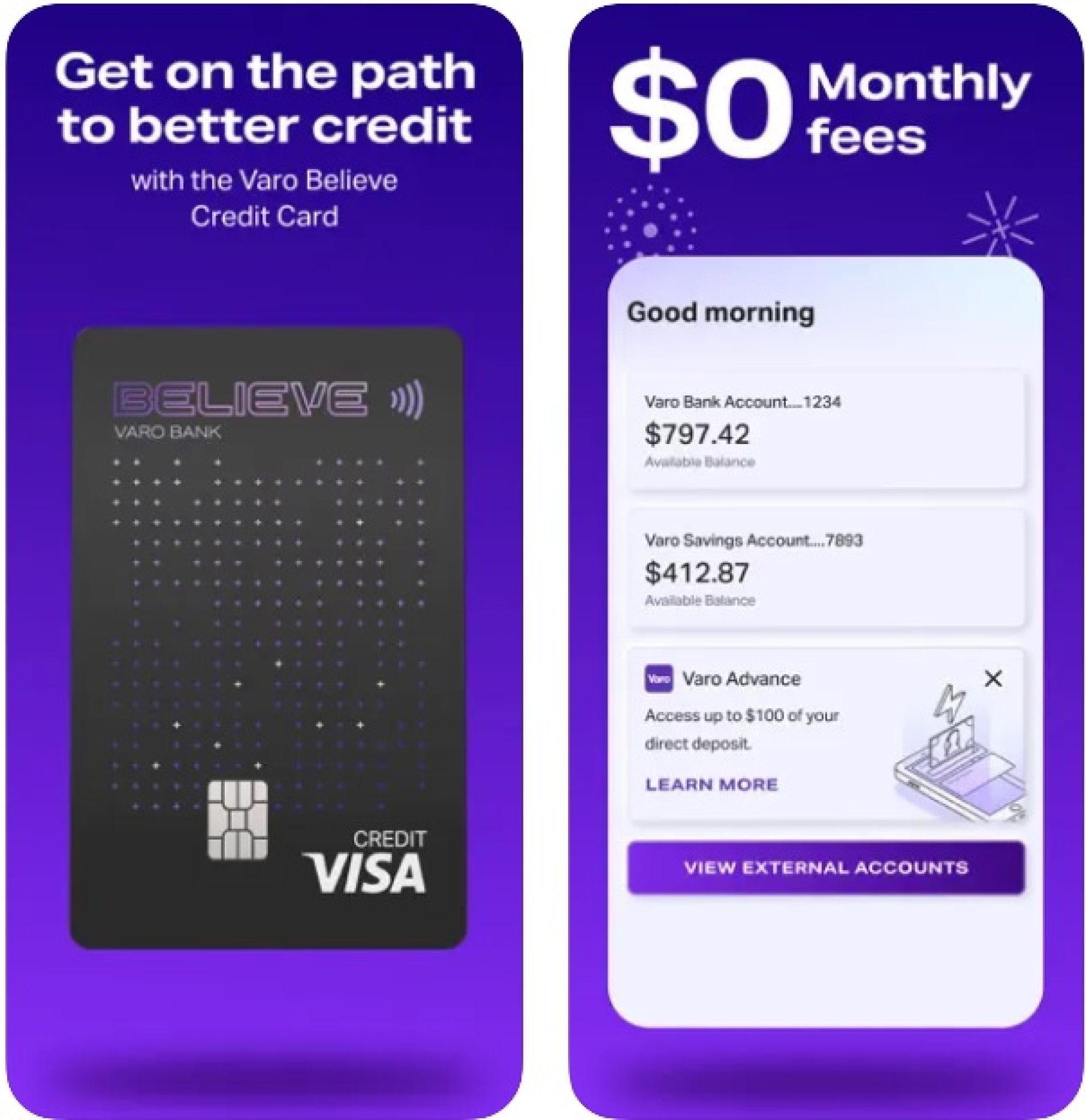

Which have a house of are a feeling that every mature features, eventually in their lives. Which emotion comes from the truth that every person desires feel financially steady and you can are now living in a home they’ve complete control out of. However some everyone is in a position to buy a home because they feel the monetary methods to get it done. At exactly the same time, discover people who might need homes fund regarding a bank or lender. Individuals choose mortgage brokers with low-rates of interest so that they do not getting financially burdened.

What’s a mortgage?

When just one would like to purchase a residential property, s/they can borrow a lot of funds from a reliable standard bank to really make the pick. New borrower should pay back the brand new houses loan which have a superior matter known as the rate of interest. Which total amount of money has to be paid off by the debtor inside confirmed time. Labeled as home financing, this might be a kind of loan that a lot of someone take after they are interested to buy a condo, bungalow, property, etc. Non-citizen Indians or NRIs usually takes home loans in the Asia because of the following the particular regulations and rules. Brand new cost out-of a mortgage has been equated month-to-month instalments or EMIs that include the primary matter and you can interest. A mortgage disbursement process is complete only when the whole number is actually paid back by the borrower.

Who is a beneficial Guarantor?

When an individual wants to get a home loan, s/the guy need to have a guarantor to vouch for all of them. This is why a good guarantor are an individual who occupies the responsibility off settling the newest construction monetary institution, if your debtor struggles to. Getting an excellent guarantor is a significant obligations as this private keeps so you can pledge their/their property because the guarantee up against a mortgage. Sometimes, this new borrower are going to be their own/their own guarantor also. Its distinguished that an excellent guarantor isn’t the identical to a beneficial co-signer out of home financing. They can not allege people directly on this new homes ordered by the new debtor.

5 A way to Sign up for a home loan in the place of an excellent Guarantor:

The reason for a great guarantor if you’re trying to get a home loan will be to give guarantee to a casing finance company. not, you are able to submit an application for mortgages which have interest rates that will be reasonable in place of an effective guarantor. This will be you can easily in certain really reputed banks and creditors inside Asia. Listed below are 5 ways that will help rating a house financing towards reduced interest even although you dont enjoys a beneficial guarantor:

Whether you’re examining mortgage brokers off a federal government lender or an exclusive financial institution, we recommend that you may have a good co-applicant when you’re completing the application. For the reason that of one’s collective grows whenever two different people apply having a mortgage. For this reason, the fresh range of going mortgages with rates according to your preferences are high.

If you n’t have a great guarantor to hope their particular/his very own property, it is just fair to incorporate a construction finance company that have good information regarding your earnings source. Hence, it is told to include records that give evidence of several money present. This can always can pay back your house financing using its rate of interest from the offered period of time.

A home loan application without a beneficial guarantor are approved when the a lowered amount of cash is borrowed by an individual. Additionally, the speed would be reasonable to possess a housing financing whenever the principal matter is not very higher. Thus, it will be easier to repay our home financing using EMIs, partial costs otherwise prepayments.

Many loan providers provide lenders that have practical notice rates in place of a guarantor. The key is to get a respected financial in your city otherwise town. Individuals loans Toxey AL who are looking do-it-yourself funds must also evaluate out various other loan providers that don’t need guarantors.

Increasing your creditworthiness is among the how can i get a mortgage accepted instead of an excellent guarantor. The CIBIL rating plays an option part within the determining if the application was approved from the a reputed financial institution or otherwise not. Thus, it is suggested to help keep your credit history good by making all of your current payments on time and you can rectifying people errors on the credit rating.

Muthoot Loans is just one of the best creditors on the country. This company will give lenders that have appropriate interest rates so you can their users. Along with this, Muthoot Funds means that the clients features more pros for example limited money, prepayments, balance transfers etcetera., instead of facing one problems.

اسپیکر

اسپیکر حراجی

حراجی لپ تاپ

لپ تاپ هدفون

هدفون

دیدگاهتان را بنویسید