دسته بندی ها

محصولات پرفروش

-

لپ تاپ دل

تومان25.000.000

لپ تاپ دل

تومان25.000.000

-

اسپیکر مینی

تومان699.000

اسپیکر مینی

تومان699.000

-

اسپیکر رنگی

تومان2.000.000

اسپیکر رنگی

تومان2.000.000

-

اسپیکر شیانومی

تومان2.100.000

اسپیکر شیانومی

تومان2.100.000

-

اسپیکر جیبی

تومان450.000

اسپیکر جیبی

تومان450.000

تگ محصولات

گالری

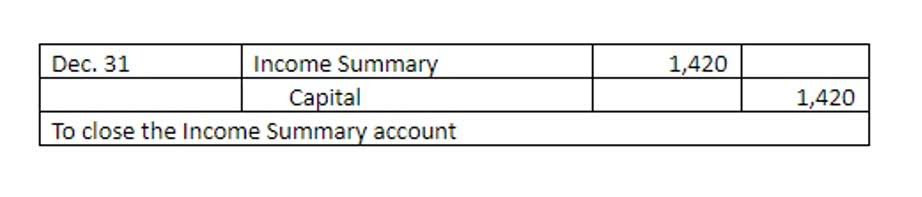

Misunderstanding normal balances could lead to errors in https://www.bookstime.com/ your accounting records, which could misrepresent your business’s financial health and misinform decision-making. A listing of the accounts available in the accounting system in which to record entries. The chart of accounts consists of balance sheet accounts (assets, liabilities, stockholders’ equity) and income statement accounts (revenues, expenses, gains, losses). The chart of accounts can be expanded and tailored to reflect the operations of the company.

How does the accounting equation relate to normal balances?

In the intricate world of accounting, mastering the basics is crucial for maintaining accurate financial records. A normal balance is the side of an account a company normally debits or credits. You can use a T-account to illustrate the effects of debits and credits on the expense account. This means that when you make a credit entry to one of these accounts, it increases the account balance.

Reflecting Reductions in Revenue:

However, this accounting convention allows for a clear representation of reductions in sales revenue. To keep a company’s financial data organized, accountants developed a https://x.com/BooksTimeInc system that sorts transactions into records called accounts. When a company’s accounting system is set up, the accounts most likely to be affected by the company’s transactions are identified and listed out. This list is referred to as the company’s chart of accounts. Depending on the size of a company and the complexity of its business operations, the chart of accounts may list as few as thirty accounts or as many as thousands.

steps to do basic bookkeeping for self employed

- When merchandise is returned by a customer or an allowance is granted, a credit memorandum (also known as a credit memo) is prepared.

- We’ve been developing and improving our software for over 20 years!

- They show changes in accounts within the bookkeeping system.

- A record in the general ledger that is used to collect and store similar information.

- Trial balances give a clear view of accounts at a certain time.

Accounts with balances that are the opposite of the normal balance are called contra accounts; hence contra revenue accounts will have debit balances. A contra-revenue account is a liability from revenue which helps in determining whether to omit certain sales transactions, which would otherwise be mistaken as revenue. It is usually included if there are any sales returns and allowances or other type of return not recorded in the sales journal.

Why is it important to understand normal balances when looking at financial statements?

- The accounts that are related to each other (the ones with the same column heading) are said to be controlled by or linked to each other, and they share a common control account.

- The Small Business Administration (SBA) highlights the importance of checking account classifications.

- The increase in inventory, an asset, is a debit because that’s its normal balance for inventory.

- Like debit memos, all credit memos are serially numbered, as shown below.

- For instance, when transactions boost accounts receivable, it’s marked as a debit.

- If the payment was made on June 1 for a future month (for example, July) the debit would go to the asset account Prepaid Rent.

The Small Business Administration (SBA) highlights the importance of checking account classifications. This helps find and fix any mistakes that don’t match the standard accounting rules. It helps avoid common errors that lead to 60% of accounting mistakes, as found by a study from Indiana University. Thomas Richard Suozzi (born August 31, 1962) is an accomplished U.S. politician and certified public accountant with extensive experience in public service and financial management. He is known for his pragmatic approach to fiscal policy and governance. So, when an organization has expenses and losses, it will typically owe money to someone.

Introduction to Debits and Credits

- When one institution borrows from another for a period of time, the ledger of the borrowing institution categorises the argument under liability accounts.

- For example, if a company borrows $10,000 from its local bank, the company will debit its asset account Cash for $10,000 since the company’s cash balance is increasing.

- The original memo is sent to the customer and the duplicate copy is retained.

- The rest of the accounts to the right of the Beginning Equity amount, are either going to increase or decrease owner’s equity.

- It keeps the company’s financials accurate and makes sure the balance sheet is correct.

It impacts a sales normal balance company’s operational costs, profitability, and bottom line. A careful look at each transaction helps decide what to record in the ledger. The increase in inventory, an asset, is a debit because that’s its normal balance for inventory. On the other hand, the cash account decreases because of this purchase, so it gets credited.

How to Analyze Accounting Transactions, Part One

The normal balances of accounts are important to consider when preparing financial statements. For example, the normal balance of an asset account is a credit balance. While those that typically have a credit balance include liability and equity accounts. Before diving into the normal balance of an account, it is essential to understand the types of accounts used in accounting. We’ve covered these in our prior lessons but we need to keep drilling these into your knowledge if you are just starting out.

Which of these is most important for your financial advisor to have?

The normal balance of an account shows if increases are recorded on the debit or credit side. Assets, expenses, and dividends or owner’s draws usually have a debit balance. Understanding the normal balance of sales returns and allowances is a foundational aspect of maintaining accurate financial records.

اسپیکر

اسپیکر حراجی

حراجی لپ تاپ

لپ تاپ هدفون

هدفون

دیدگاهتان را بنویسید